Microsoft's $26 billion acquisition of LinkedIn will likely be the biggest business deal of the year, almost certainly in the tech industry. However, Avast deciding to fork out $1.3 billion to buy AVG could be the most important in terms of shaping internet security for the foreseeable future.

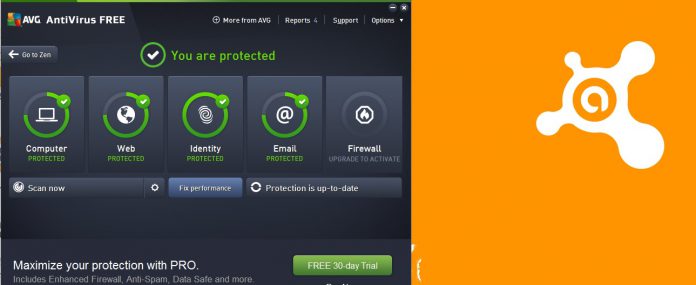

The two are among the leading providers of antivirus software, famed for offer free suites, but also selling full antivirus at a cost. Avast Software's acquisition of AVG Technologies creates one of the biggest antivirus operations in the world and will have access to “400 million endpoints.”

That is a lot of machines that will be relying on antivirus protection from a single company, and over half are on mobile, an increasingly important part of the antivirus market.

Avast will pay $25 for each of AVG's outstanding ordinary shares, and the company will make the $1.3 billion purchase in cash. Both companies were born more than two decades ago in the old Czechoslovakia and have grown into globally recognized brands of the PC and internet age.

AVG was founded in the early 1990s and some of us of a certain vintage can still remember when it was called Grisoft. The company (now based in Amsterdam) has since grown into one of the leading providers of desktop and then mobile security apps and services.

Avast was already making a name of itself before AVG launched, with the company operating in Prague since 1988. It too grew to become a go to choice for users wanting to protect their PCs and mobile devices from malware and other infections. Avast is hugely successful and is thought to control around 20% of the antivirus market.

With the acquisition of AVG, Avast can expect to expand its market reach even further. The company confirmed that the purchase was made to “gain scale, technological depth, and geographical breadth” and so it can “take advantage of emerging growth opportunities in internet security, as well as organizational efficiencies.”

“We are in a rapidly changing industry, and this acquisition gives us the breadth and technological depth to be the security provider of choice for our current and future customers,” said Vincent Steckler, CEO of Avast. “Combining the strengths of two great tech companies, both founded in the Czech Republic and with a common culture and mission, will put us in a great position to take advantage of the new opportunities ahead, such as security for the enormous growth in IoT.”

AVG will have to go through a process of seeking shareholder approval as it is publically traded on the New York Stock Exchange. Avast says it envisions no obstacles and expects to close the deal in September or October.