Microsoft, buoyed by success on the cloud, is expected to announce a bumper first quarter on Thursday, which could lead to a record stock price for the company.

A few years ago, during the closing stages of Steve Ballmer’s era as CEO, Microsoft was on the rocks and the future looked uncertain at best and bleak at worst.

The company had an unclear strategy that seemed to be turning it from a three decade software giant into a fledgling hardware business in a sea of companies who were frankly doing it better.

Fast forward half a decade and the company is in excellent health under the tenure of CEO Satya Nadella and the company’s stock is reaching record levels.

Microsoft’s first quarter earnings call on Thursday is likely to be stellar, which will push the share price to levels that have never been seen at Redmond.

Certainly, it seems that Ballmer’s worrying era has been formally put into the history books and can be filed under “the lost decade,” and once again Microsoft is looking like the juggernaut tech company it always was. This resurgence is not without caveats, the poor performance of the company’s mobile business hangs like a cloud.

Speaking of clouds, it is on the cloud that Microsoft is now regaining its mojo and mixing once again with Apple at the top of the tree. Indeed, the company’s cloud strategies have more than offset the poor mobile performance and the continued decline of the PC market both for consumers and enterprise.

The company’s shift to a cloud first provider is evidenced by the fact that Intelligent Cloud” counted for 28% of the Microsoft’s total revenue through the second half of 2015. A targeted shift to the cloud meant this was an increase of 23% compared to 2014, and it is a trend that is likely to continue in 2016.

Cloud services are vastly outperforming other areas such as tablets, smartphones, Xbox, and even Windows, and aside from the Windows platform it could be successfully argued that cloud is propping up the mobile hardware and games divisions.

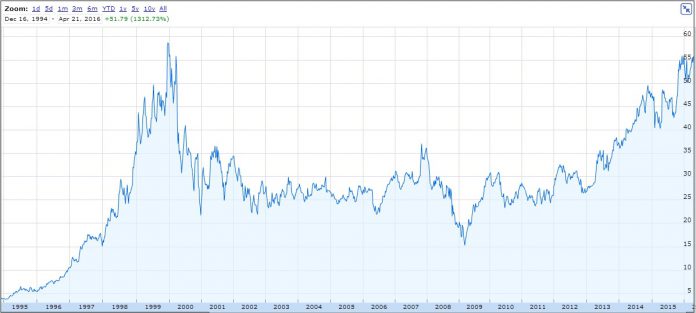

Shares have more than doubled since January 2013, and stock is approaching levels comparable to when Microsoft was sweeping all before it and being reprimanded for monopolizing. Sure, the company may never reach those all-encompassing heights again, but stock is only 7% short of the December 1999 record.

Make no mistake, it is a remarkable turnaround that few predicted would happen. Indeed, many predicted the demise of Microsoft after Ballmer’s tenure, but under Mr. Nadella the company has hit back and is once again growing on the back of software and services.

It is a stark contrast to the misguided belief that Microsoft could compete with the market demand of Apple’s hardware, or the sheer scope of the Android platform. A quick glance at Build 2016 shows a company back in its element and creating user experiences that matter and change the industry.

It should make happy reading for Microsoft to see that slowly Apple has stopped outperforming the company over the last five years (above) and Microsoft is slowly starting to top its old foe. Analysts working with FactSet say that Microsoft’s per share price will rise 4% year on year to 64 cents, while revenue will increase to $22 billion (a 2% rise).

Microsoft’s old rival Apple is not really a direct competitor these days considering one (Apple) is entrenched in hardware and the other (Microsoft) is cloud/software focused. However, Cupertino’s mammoth success over the last 15 years has made it the company against which all other are judged.